New Accounting Standard Update (ASU) 2016-14

The Financial Accounting Standards Board (FASB) issues these new standards. This new standard affects nonprofit organizations in all industries (i.e. healthcare, affordable housing, social services, foundations, and education) and is effective for fiscal years beginning after December 15, 2017 (Calendar Year 2018 or Fiscal Year 2019).

ASU 2016-14 requires nonprofits to provide the following:

- Qualitative information in the notes to the financial statements on how the nonprofit manages its liquid resources to meet cash needs for general expenditures within one year of the statement of financial position date

- Quantitative information either on the face of the statement of financial position or in the notes about the availability of a nonprofit’s financial assets to meet cash needs for general expenditures within one year of the statement of financial position date.

Why a liquidity policy?

Forming a liquidity policy will provide more clarity to readers of financial statements on what resources are available to support ongoing operations. They can also make it more apparent when your organization is in a strained financial situation.

How to develop a liquidity policy:

When developing a liquidity policy, it is a good idea to have a goal in mind for a certain number of months’ expenditures to have available on hand as liquid assets. These could be in cash, cash equivalents, or highly liquid investments. The number of months can vary significantly based on the nonprofit. The more consistent monthly and yearly revenues are, the goal is likely to be fewer months of expenses (such as two or three months). The more variable the revenues are from year to year, or even month to month, the longer the period for the goal.

All nonprofits should create a budget. However, liquidity management is more than just budgeting. It is looking on a month-by-month basis to budget for cash inflows and outflows. Some months may need to rely on some cash reserves, and some months have extra cash that could be invested. In calculating this cash flow projection, management needs to address how to survive those times with negative cash flows, such as using a line of credit, utilizing liquidity reserves, reducing expenditures, or drawing from long-term investments. Management may also need to address what to do with excess cash; should it go into a CD, short-term investments, long-term investments, or put into use with a special project?

Implementing the new Accounting Standard Update:

During implementation, nonprofits should first identify all financial assets and any limitations on the availability of the identified financial assets. Financial assets are defined under U.S. generally accepted accounting principles as cash, contracts to receive cash (i.e. receivables, debt securities), and evidence of equity ownership in another entity (i.e. equity securities).

The availability of financial assets may be affected by the following:

- The nature of the financial asset.

- External limits on financial assets, such as those imposed by donors, grantors, laws, and contracts with others.

- Internal limits on financial assets, such as those imposed by governing board decisions.

The policy should consist of the following items:

- Procedures to identify financial assets and assess the availability of each financial asset to meet cash needs for general expenditures within one year of the statement of financial position date.

- Procedures to identify liquidity risks, strategies, and actions taken to manage liquidity needs.

Presentation in financial statements:

Nonprofits should also determine the best way to disclose the liquidity information in the financial statements. Nonprofits may choose to present the required disclosures in either a table format and/or text format in the notes to the financial statements. In addition, if a table format is preferred, nonprofits have two options to display the balance of financial assets available within one year from the statement of financial position date for general expenditures:

- Display the gross amount of financial assets, then adjustments to arrive at the balance available for general expenditures.

- Display only the net amounts available for general expenditures.

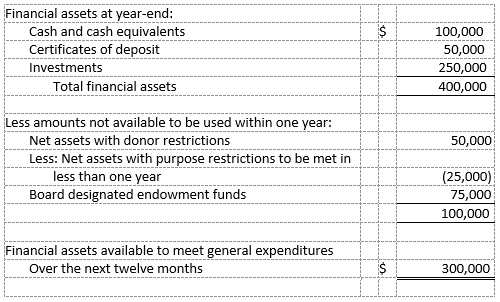

Common liquidity and availability disclosure example:

The following represents “Nonprofit ABC’s” financial assets at December 31, 2019:

Nonprofit ABC strives to maintain liquid assets sufficient to cover 90 days of general expenditures. Financial assets in excess of daily cash requirements are invested in certificates of deposit, money market funds, and other short-term investments.

At Forge Financial and Management Consulting we understand that when new standards arise they can be difficult to implement. If you need assistance in effectively implementing and creating a liquidity policy, we’re here to help. Be sure to look for future articles explaining other new auditing standards.

[/fusion_text][fusion_widget_area name=”avada-custom-sidebar-blognewslettersign-up” title_size=”” title_color=”” background_color=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” /][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]Learn What Your Business Needs Most to Unlock Faster Growth

Your business relies on four key areas, or centers of intelligence, to thrive. Take the free Business Intelligence Grader to see how you score across financial, leadership, productivity, and human intelligence and learn where to focus to drive greater results.

Your business relies on four key areas, or centers of intelligence, to thrive. Take the free Business Intelligence Grader to see how you score across financial, leadership, productivity, and human intelligence and learn where to focus to drive greater results.