Liquidity is essential for businesses to survive and thrive. Liquidity is a measure of available liquid assets, with cash being the most important. A company’s employees, vendors, and other stakeholders expect the company to maintain adequate liquidity to meet its obligations. It makes sense that liquidity should be factored into important decisions, but it’s often an afterthought. As your business looks ahead to new projects and initiatives, you should make sure liquidity is a top consideration. The common mantra of “we’ll figure it out” applies in many instances, but knowing each option’s impact is crucial to making the right call when it comes to liquidity. Running out of cash is a crisis, and proactive planning for specific scenarios will provide the necessary clarity for prudent decision making, and avoiding a liquidity crisis.

Managing liquidity is as simple as collecting the information to determine the cash flow effects and projecting cash flows. Still, a significant amount of information will often need to be collected and analyzed to arrive at valid inputs for the model. In performing this exercise, be sure to double and triple-check the inputs – base your projections on realistic assumptions and not on a best-case scenario.

Let’s look at an example scenario:

Your company faces three options for a new service offering, which requires a physical location for customers (in all three instances, the new service is similar).

Option 1

Set up at a new leased location. Startup costs of $400,000 over two years include leasehold improvements, supplies, and hiring and training new employees. Expected revenue is $300,000 per year once the activity ramps up, with costs of $200,000.

Option 2

Offer the service through a 3rd party contractor, at their location, instead of setting up a facility and running it. The initial startup cost is $50,000 and costs are an additional $175,000 each year for contract labor. Revenues under this option are lower as the service may not be as appealing when a contractor runs it and capacity is limited.

Option 3

Expand current facility (construction project), more efficiently utilize existing employees, and hire some new employees – startup costs of $700,000 all in year one, primarily for construction. This option is expected to have only $75,000 of revenue in year one due to construction time, and expected to grow to $425,000 (maximum capacity) by year 5.

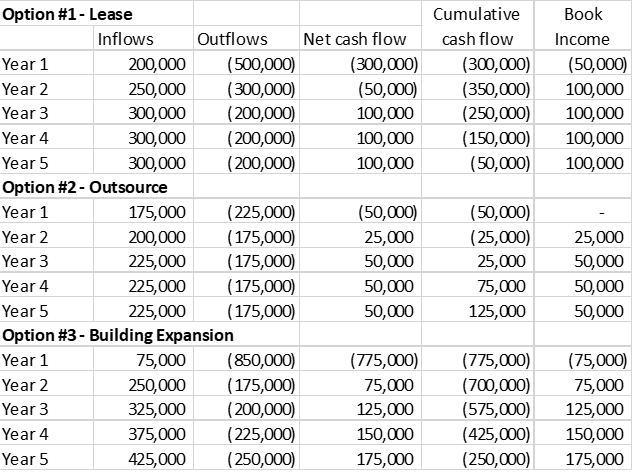

Below is a table showing the cash inflows (revenue) and outflows (expenses and capital items). The net cash flow column shows the cash flow for the year, and the cumulative cash flow column shows the effect on cash since the new service began.

Note – For purposes of this simple example, depreciation expense is ignored for the “book income” column.

Below are some thoughts considering the analysis above:

- As you can see, Option 2 (outsourced option) provides the best cash flow over the first five years (it’s the only option that’s cash flow positive within five years). However, it also has the lowest income (maximum of $50,000 per year). Option 3 (facility expansion) provides the highest income, but even by year 5, it’s still a couple of years away from breaking even from a cash flow perspective. Option 1 is a middle ground and would have positive cash flow by year 6.

- If the company has adequate reserves and the extra cash to fund Option 3 organically, that option should be selected. Option 3 would likely also come out ahead if a competitive rate loan could be obtained (using a 5% interest rate and financing the entire project, Option 3 would incur about $80,000 more in interest expense than Option 1).

- Option 1 will be the right choice if the company isn’t comfortable with the risks of Option 3 or if the revenue is more uncertain. Option 1 might make sense if it’s easier to qualify for a $300,000 loan than a $775,000 loan from a financing perspective.

The example above is a simplistic model. Decisions regarding liquidity are rarely this simple, but documenting the different options and the effects on cash flow is essential to ensuring liquidity exists to meet obligations and continue with growth. A model to capture all the relevant information can grow increasingly complex but can usually be built in Excel with some time. At Forge, we’re available to explain the process and work with your business to gather the information needed, create scenarios, and project your cash flow. If the analysis seems complex or overwhelming, we’d be happy to help with models and planning to ensure you have the best information to make decisions. Contact us today.

ABOUT THE AUTHOR

Ross Van Laar

Relevant Posts

Learn What Your Business Needs Most to Unlock Faster Growth

Your business relies on four key areas, or centers of intelligence, to thrive. Take the free Business Intelligence Grader to see how you score across financial, leadership, productivity, and human intelligence and learn where to focus to drive greater results.

Your business relies on four key areas, or centers of intelligence, to thrive. Take the free Business Intelligence Grader to see how you score across financial, leadership, productivity, and human intelligence and learn where to focus to drive greater results.